When someone’s life is in jeopardy because of a medical condition, they will do whatever it takes in order to beat their illness and stay alive. Unfortunately, those lifesaving treatments don’t come cheap and survivors are often left with crippling debt upon recovering.

Instead of enjoying their new lease on life, people with medical debt are being forced to work to the bone trying to keep up with their bills. In late 2018, however, hundreds of New Yorkers were stunned to find out their debt had mysteriously been paid off just in time for the holiday season.

The Cost Of Living

When faced with a life-threatening or debilitating medical emergency, most people choose to fight for their lives and do whatever their doctors tell them is their best chance of regaining their health and quality of life. However, that usually requires countless costly tests, lab work, procedures, and medications.

A Mountain Of Bills

Even with insurance, the bills can still pile up at an alarmingly fast pace. By the time people do manage to overcome their conditions and regain their health, they are left with a mountain of medical bills. Instead of enjoying their second chance at life, those people now have to scramble to try and find a way to pay their debts.

Uncontrollable Debt

For millions of Americans with past-due medical bills left from their time getting treatment, those bills eventually get passed on through several collection agencies. Over the following months and years, those debts start to severely damage debtors’ credit.

A Hopeless Situation

As a result, people across the country with medical debt are left feeling hopeless. While they continue to get hounded by debt collectors, their debts are also ruining their credit and ruining their chance of being able to buy or rent a home, get a loan, or even get a job to help them pay their debts back.

A Common Problem

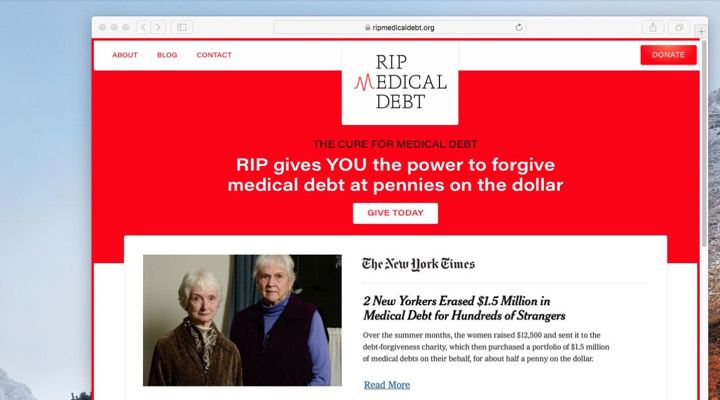

“As medical costs rise to unspeakable levels, so does un-payable medical debt,” RIP Medical Debt, a nonprofit that buys and clears medical debt, claims on its website. According to troubling statistics, more than one in three Americans struggle to pay for medical care.

Vulnerable Targets

“Medical debt has destroyed the financial stability of large segments of America’s most vulnerable communities: the sick, the elderly, the poor, and veterans. It also particularly targets the middle class, driving many families who are barely getting along into poverty,” RIP Medical Debt’s website explains.

A Widespread Problem

Today, there are now 43 million people in the United States who owe a combined $75 billion. Those people are forced to take on second jobs, work longer hours, or even beg for help from charities or fundraisers like GoFundMe in order to stay afloat.

Desperate For Help

Because of medical debt, millions struggle to pay for basic needs like food, rent, and utilities every year. According to GoFundMe’s CEO, Rob Solomon, one out of every three GoFundMe campaigns is to help people struggling with medical bills and debt.

Medical Bankruptcy

Those who can’t come up with money to pay back their debts are forced to go into medical bankruptcy. Shockingly, a majority of those people actually had health insurance. According to RIP Medical Debt, three out of every four people who declare bankruptcy from medical debt had insurance.

An Eye-Opening Issue

In 2018, two Ithaca, New York women, 80-year-old Judith Jones and 70-year-old Carolyn Kenyon, started to realize how debilitating medical debt really is after hearing about RIP Medical Debt. “The further we got into it, the more we realized what a serious issue medical debt is,” said Jones, a retired chemist.

Inspired To Help

“One thing that really struck me in my research was the medical debt incurred by women who had metastatic breast cancer,” Jones told the Times Union. “When you start to learn how bad the problem is, it makes you want to do more,” Jones added.

Universal Healthcare Advocates

Before finding out about RIP Medical Debt, both Jones and Kenyon, a psychoanalyst, were members of the Finger Lakes chapter of the Campaign for New York Health. The campaign advocates for universal healthcare and fights for the New York Health Act.

Making A Statement

However, when the two women realized just how much people are suffering now because of the cost of medical care, they were inspired to do something with a more immediate impact. Not only did they want to help people, but they also wanted to make a political statement at the same time.

Executives With A Heart

Jones and Kenyon learned how RIP Medical Debt was founded in 2014 by Craig Antico and Jerry Ashton, two former executives from the debt collection industry. Even though they knew there was a bigger underlying problem with the high medical costs in the United States, the two men didn’t like the way debtors were being treated.

Looking For Debt

So the pair came together and started their non-profit, which works by buying up medical debt by working with third-party credit data providers. With the date providers’ help, RIP Medical Debt searches for bundled debt portfolios that meet their criteria for financial relief.

Debt Forgiveness

They then negotiate to buy those portfolios for discounted prices. Typically, they pay about a penny on the dollar for the debt portfolios and then forgive the debt. “I like doing this much more than I liked doing collecting,” Antico told The New York Times.

The Fundraising Campaign

Jones and Kenyon were inspired by what the nonprofit was doing to relieve medical debt and decided to raise money with the intention of helping people trapped under medical debt in New York. “The way sort of opened,” Jones told The New York Times. Over the summer of 2018, the pair raised $12,500.

Saving Thousands From Debt

After finishing up their fundraising campaign, Jones and Kenyon sent the money off to RIP Medical Debt. With that money, the nonprofit was able to purchase $1.5 million worth of debt. According to RIP Medical Debt, that debt had belonged to 1,284 people throughout upstate New York.

Relieving Some Stress

The holiday season can be incredibly stressful for everyone. But for people in debt, the holiday season is a particularly difficult period. For that reason, RIP Medical Debt decided to let debtors from New York know the exciting news in the winter of 2018 by sending out notices in small yellow envelopes.

‘Too Good To Be True’

“A lot of people get our letters and think they’re too good to be true and throw them out,” Daniel Lempert, a spokesman for RIP Medical Debt, told the Times Union. “That’s why we try to get the word out. We really just want people to be aware of what a terrible problem medical debt is. And we want recipients of these letters to know this debt is finally off their credit report.”