Life for Nathan and Madison Donovan had been anything but easy for the past few years. Surviving off social assistance was a way of life for this couple and their two young kids, and they had no choice but to take any help they could get to raise their children.

When the Donovans applied for an online loan of $7,000, they were confident that it would ease them out of the rut they had been sinking deeper and deeper into over the past few months. Once they realized they were being scammed, it was too late to do anything about it.

Working Couple

Both Nathan and Madison had worked hard their entire adult lives. When Nathan was involved in a serious car accident back in 2010 causing an injury to his back, he didn’t know if he would ever be able to work again. Madison had wanted to return to work for years but had been unable due to having two young children to care for. Life was hard but this average American family made the best of their lot.

Night Shift

When money got tight for the family, Madison would work the graveyard shift at a downtown call center but she needed a car to get too and from the center as buses don’t run in the area through the night. The Donovans needed a car badly, but they weren’t even close to being able to afford one. They started googling online for loans to see what they could find.

Co-Signing

Nathan’s mother who lives out in Nova Scotia would have done anything to help her son to improve his financial situation. When Nathan applied for a $7,000 loan online, his mother was happy to co-sign for him. As it was impossible for her to travel to where her son lived in Moncton to sign the documents, they opted for a company on the internet offering “bad credit loans.”

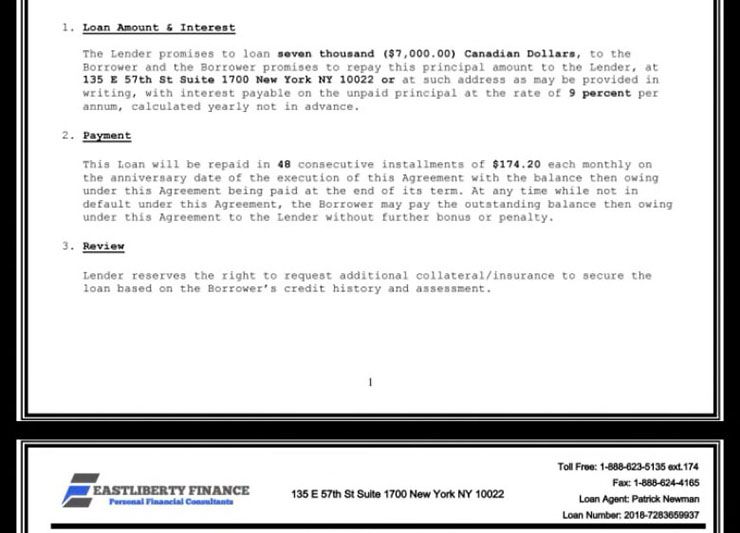

First Page

Many people assume that when they search for something on Google and it features high up on the first page of search results it must be legit. When the Donovans found EastLiberty Finance Group, based in New York, at the top of their search they decided to apply for an online loan. As Nathan explained, “It wasn’t, like, on the 14th page and it’s getting kind of sketchy,” he said. “It was on the first page.”

Looking Good

Nathan knew he would be charged some serious interest, but at this stage, he didn’t care. He would do anything to feed his family and support them, so he went ahead and applied for the loan. “The website looked very legit. They had licensing numbers, their tax numbers … they sent us their loan papers, and we were able to sign them online, like digitally sign them. Everything looked on the up and up,” Nathan explained according to a CBC report.

Getting Excited

When Nathan received confirmation that he was approved for the loan by the company’s loan officer he was excited. Having been approved, the Donovans were informed that the full amount of the loan would be sent to them within just four to six hours. But the money didn’t arrive within that timeframe, so they called the company to see what was happening.

Further Collateral

This is where their predicament took a turn for the worse. When they contacted the loan company, they were told that they needed to provide $600 as “further collateral” and that they would also need to purchase loan insurance. What started as a simple online loan was getting complicated, and the Donovans’ excitement dwindled.

Getting Scammed

The Donovans made an honest mistake and had no idea they were being scammed. Nathan did think it a little strange when he was told to make a transfer through Western Union to Ontario, Canada, but he was more interested in securing the loan than anything else. “It would get us up out of the hole we’re in,” Nathan said, and that was his main focus at the time.

Following Protocol

Nathan went on to explain that the loan wasn’t what he thought it was, and that he was now feeling suddenly duped. “They said it needed to be sent to Ontario to be able to transfer the money to the United States because the company was based out of New York. So I kind of fell for it there – you know, it had to be sent over the border, so maybe there were some protocols that I didn’t know about. I bought it,” he said.

Website Down

It took a while for the penny to drop after Nathan emailed and called the loan company demanding his $600 back. The fact that their website went down and no one answered their toll-free number raised alarm bells in Nathan’s head but his last $600 had already been sent, and he had no way of getting it back. He reported the incident to the police but knew deep down that his money was gone and his loan wasn’t coming.

Pretty Embarrassing

“It’s pretty embarrassing really,” Nathan said. “I’d say a lot of people probably get this done to them … and they don’t say anything because they’re embarrassed.” But Nathan reported the company to the RCMP, the Better Business Bureau and the fraud division at Western Union, in the hopes of seeing some justice or at least stopping this company from scamming others.

Complaints Investigated

RCMP Cpl. Laurent Lemieux is with the financial crime unit in New Brunswick. He said that this complaint, like countless others, was investigated but that there are so many online scams that it’s hard to follow up on each one. Especially when funds are transferred out of the country, like in this case, it’s almost impossible to retrieve.

Middle Man

Cpl. Lemieux explained that often the person picking up the money from Western Union in Canada is a victim too. “The middle person would not even benefit,” he said. “They’re just in a love relationship, and they’re being told, ‘I need help to get $4,000 over here. I’ve got a friend that’s going to wire it to you, can you forward.'” But paying advance fees is illegal in Canada, even if Nathan didn’t know that when he parted with $600.

Advance Fees

According to Peter Moorhouse, president and CEO of the Better Business Bureau in Atlantic Canada, not all online lenders are scammers, but the ones who ask for advance fees usually are. Talking about requests for advance fees Moorhouse said, “That’s actually illegal in Canada, so the fact that that was the structure of this arrangement, that’s what distinguishes it as a scam.”

Targeting The Poor

Moorhouse explained that these scammers almost always target the poorest people, leaving them even more crippled after they part with advance fees. “It’s most frustrating when you see scams that target the most vulnerable members of society in this way,” Moorhouse said. “I think you have to be a special sort of evil to target people who can’t really afford to be scammed in the first place.”

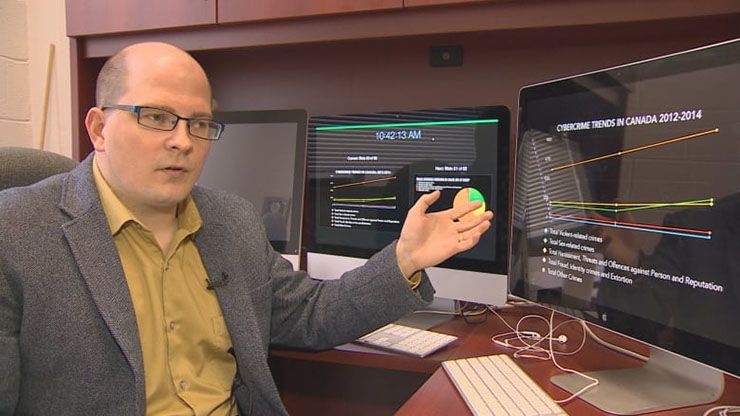

Police Overwhelmed

The CEO of Beauceron Security and a certified cybersecurity expert in Fredericton, David Shipley, also spoke to reporters, explaining that the police are overwhelmed with online scams. “What’s really sad is that when you’re talking about the $600 – it’s really meaningful to that couple, but from a policing standpoint, they just aren’t resourced to deal with crimes under $50,000,” he said.

Blaming Poverty

According to Shipley, the problem starts with the state of poverty some couples find themselves in. He said that universal basic income needs to be reformed so that people don’t end up getting scammed by online schemes such as these. “How do we help people get a hand up so that they can do what this couple was trying to do, which is get re-established and live healthy, productive, economically well-off lives,” Shipley asked.

Hopes Dashed

For the time being, Nathan’s hopes to buy a car and better his lot in life have been “dashed” according to him. “I almost walked out of Sobeys the other day with two loaves of bread, and I turned around and went back,” he said after he could only afford one loaf of bread that day. “I can’t walk away with two loaves of bread – you know what I mean? But other people can just take everything you have.”

Happy Ending

Luckily for the Donovans a generous and kind couple had heard about their plight on a local radio show. Denis LeBlanc of Dieppe and his wife had been trying to sell their 2007 Volkswagen Jetta on Kijiji for $3,700. Having only received low offers, LeBlanc decided then and there to just give the car to the Donovans. “We had some ideas of what we were hoping to do with the money from the sale of the car. I said, ‘Can we swing it if we don’t make money on this or any money at all?’ And she goes, ‘Yeah – I think we can do that.'”

Going Awesome

The kindness of these perfect strangers changed everything for Nathan and Madison. As they now have a car, Madison has returned to work full-time. As Nathan explained, “Everything is going awesome. The car is great.” He added, “Madison is working full time, and we are no longer on assistance, which was our goal. We have a renewed sense of hope not only in our financial future but in our fellow man.”